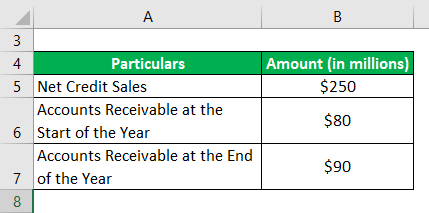

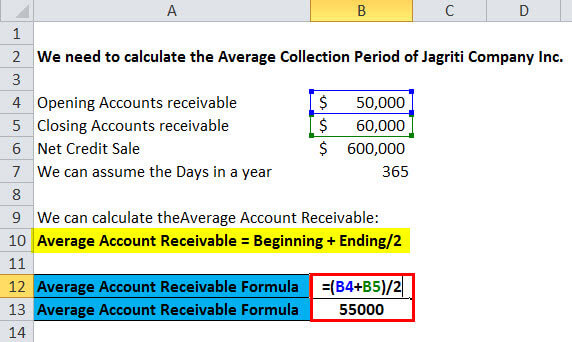

We have already discussed the formula of how to calculate the ratio. Receivables on faster pace thus affecting the accounts of the company.Įxample of How to Use the Receivables Turnover Ratioīy now you must have received a fair and precise idea of the receivable turnover ratio. This will help the company in keeping the Will directly have a larger number or receivable credits. That the company’s policy runs majorly on receivable credit account. Will hardly have any receivable credits and affects the financial reports. That the company’s policy does not leverage the credit account much and deals

Profit and has some high paying capacity client.Ĭhurn of the business is on the lower side or the clients are not high on What the receivable turnover ratio can tell you High Account Turnover and Low Account Turnover This helps the investors understand which business will be the best fit for their investment. When the receivable turnover ratio of a business is lower than its competitors, it means the business is making less profit. The receivable turnover ratio also helps investors making the right decisions. It also helps in analyzing how often the company is carrying out a collection cycle, and if there is a recurring pattern formed or not. The receivable turnover ratio helps a business in analyzing if the company is making a profit with the credit or not. Profitability by Credit Practiceįor any business, it is important to understand the cycle of credit and the churn of credit in sync with profitability. This gives the information on how much cash has been generated by the company in a month, in a quarter, and in a year. The ratio also ensures to measure the number of turns the receivable turnover took. Receivable turnover ratio helps in understanding the efficiency of collecting the receivables of the company. Thus it can be considered as an interest-free loan. But the business charges no interest on the amount. The time frame a customer takes to make the payment is treated as interest-free time. However, a business is liable to give a time frame of 30 – 60 days to the customer to make the payment while billing. This amount is supposed to be paid when the purchase is made. The receivable amount is the amount a customer owes to your business. But here are things receivables turnover ratio can tell you. Your accountant is well skilled to manage all the accounts. You do not need a keen eye to understand it all. The receivable turnover ratio indirectly speaks a lot. Here is the formula that will help you calculate the receivable turnover ratio for your business.įormula – What the Receivables Turnover Ratio Can Tell You? If the receivable turnover ratio has to go in the books of the business, it has to be calculated first. How to Calculate Receivable Turnover Ratio? Gives a base to compare the accounts with competitors.Understanding the receivable amount on an average for the year.Estimating the efficiency of payment collection by business.The calculation of this ratio will be a great help to your company. For example, if the business has due receivable credits of $ 11,000, but the company was able to retrieve $22,000, the number of times will be counted as 2. The number of times implies the number of times your business was able to recover the average receivables. These receivables are the credits due with customers for the business. This account precisely measures the ratio of the number of times the business is able to collect its account receivables in a year. For the rest, this account deals with the credits receivable from the customers. The name accounts receivables turnover ratio gives away half of the story. What is Account Receivables Turnover Ratio?

Determining a Firm's Percentage of Credit Sales.Limitations of Using the Receivables Turnover Ratio.Example of How to Use the Receivables Turnover Ratio.What the Receivables Turnover Ratio Can Tell You?.High Account Turnover and Low Account Turnover.How to calculate Receivable Turnover Ratio?.What is Account Receivables Turnover Ratio?.We are here to tell you all about the receivables turnover ratio that goes into double-entry bookkeeping. It’s fine if you are not aware of the details of this calculation. One of the most important accounting calculations for any business dealing with customers would be the receivables turnover ratio. There are millions of accounts and formulas to know and understand in business accounting. You can own a tiny restaurant or a multimillion-dollar Automobile company, the accounting books will always be there. As a business owner, there is no way you can escape indulging in accounting activities.

0 kommentar(er)

0 kommentar(er)